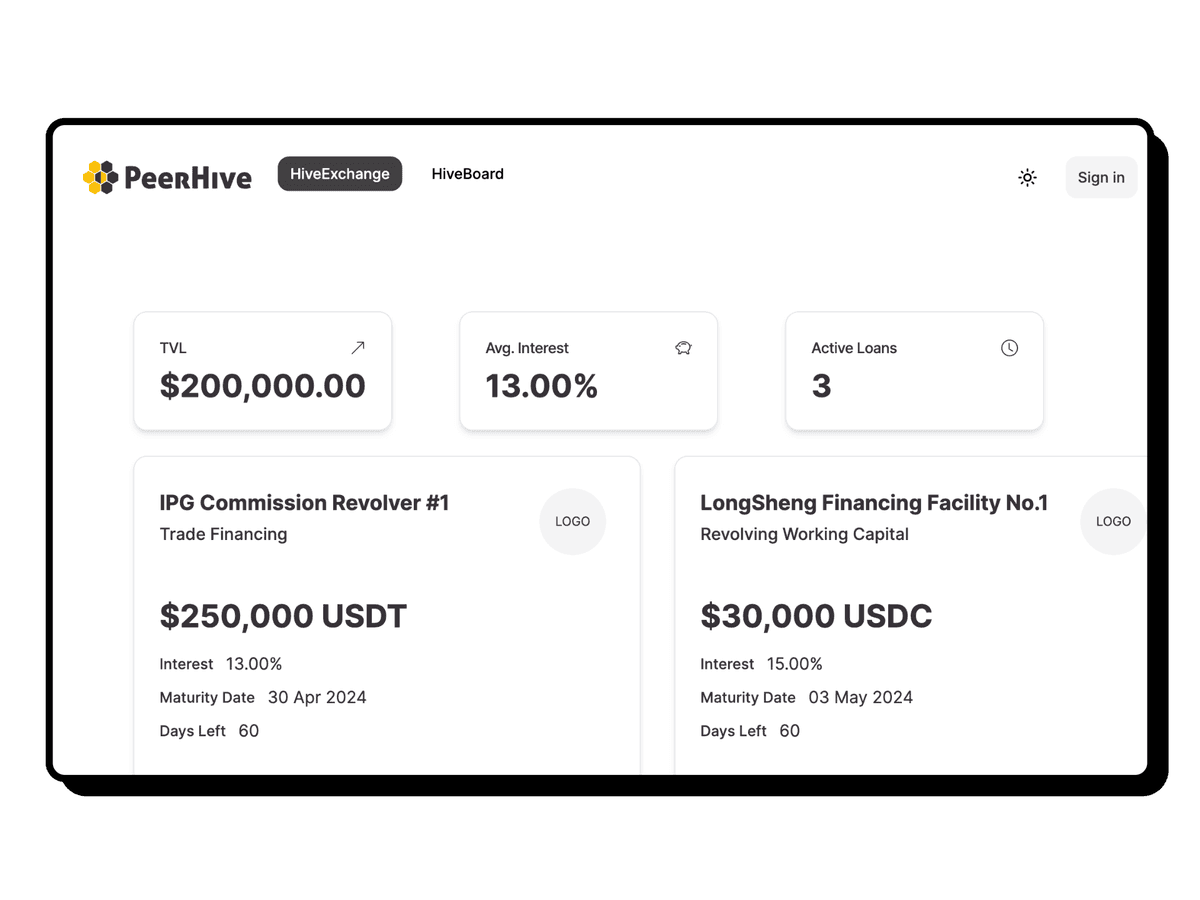

Invest In What Matters

Impactful Real World Asset (RWA) Backed Loans with P2P financial.

Shift from Crypto Games to Real-World Impact: Lend Your USDC to Global Businesses

PeerHive Selected for SC Regulatory Sandbox

We are proud to announce that PeerHive has been selected for the first cohort of the Securities Commission Malaysia's Regulatory Sandbox. We are working towards deploying our innovative alternative financing solutions within a regulated framework.

Read the Press ReleaseExplore PeerHive Campaign Deals

PeerHive offers real-world yield through collateralized investment.

PeerHive

Fintech Player in Southeast Asia

Est interest rate

15 %

Loan Tenure

2 Months

PeerHive

Fintech Player in Europe

Est interest rate

20 %

Loan Tenure

4 Months

PeerHive

Fintech Player in Asia

Est interest rate

12 %

Loan Tenure

3 Months

Deals above are illustrative

Join our PeerHive Community of Private Investor

We carefully select our private investor to ensure harmonious community. Join us now to get access on the upcoming opportunities.

Invest in Sustainable Yields

Put your stablecoin to work by investing in sustainable, real-world opportunities. PeerHive connects you to impactful projects that generate meaningful returns.

Global Market Access

Diversify beyond borders. With PeerHive, your stablecoin investments transcend geographical boundaries, allowing you to participate in global markets.

Uncorrelated to Crypto Markets

Unlike highly volatile cryptocurrencies, Real World Asset Loans are backed by tangible assets, such as those from SMEs.

Seamless Investing: Powered by Our Trusted Partners

PeerHive is committed to providing you with a seamless and secure investment experience. To achieve this, we've partnered with industry leaders in various areas:

Investing in a Peer-to-Peer lending protocol carries inherent risks. By providing funds to companies seeking loans, you expose yourself to the possibility of loan defaults, potentially resulting in partial or complete loss of your investment. It is advisable to conduct thorough research before making any investment decisions. Do your own research.